End-to-End Client Onboarding Automation Across Multi-Platform Integration

About the company

Guiding Wealth is a financial planning firm based in Dallas, Texas, specializing in wealth management and financial advisory services for complex financial situations.

Tech Stack Used

Calendly, HubSpot (Enterprise) Marketing | Sales | Operations, Zapier, DocuSign, Box, Redtail CRM

.png)

.png)

Diverse Project Scopes, Proven Expertise

From customized automation workflows to intricate, multi-platform integrations, Flora & Fauna Technical Solutions has consistently delivered solutions that elevate client operations and user experiences. Discover our work on comprehensive onboarding workflows, cross-platform data syncs, and secure document management systems tailored to streamline processes and ensure accuracy.

Onboarding Automation

Designed and implemented an end-to-end onboarding workflow that automates client intake, including lead tracking, follow-ups for pending documentation, and task assignments based on key intake form responses.

Multi-Platform Integration

Integrated several platforms for seamless data transfer. Syncing contacts, deals, and custom quote management workflows, we streamlined document and data management processes with a centralized view of client information across all deal stages.

Document Management

Automated secure document storage and organization within Box, ensuring client files are compliant and easily accessible. Additionally, track and trigger reminders for disclosures and agreements for legally-compliant records.

-1.png?width=720&height=720&name=Untitled%20design%20(48)-1.png)

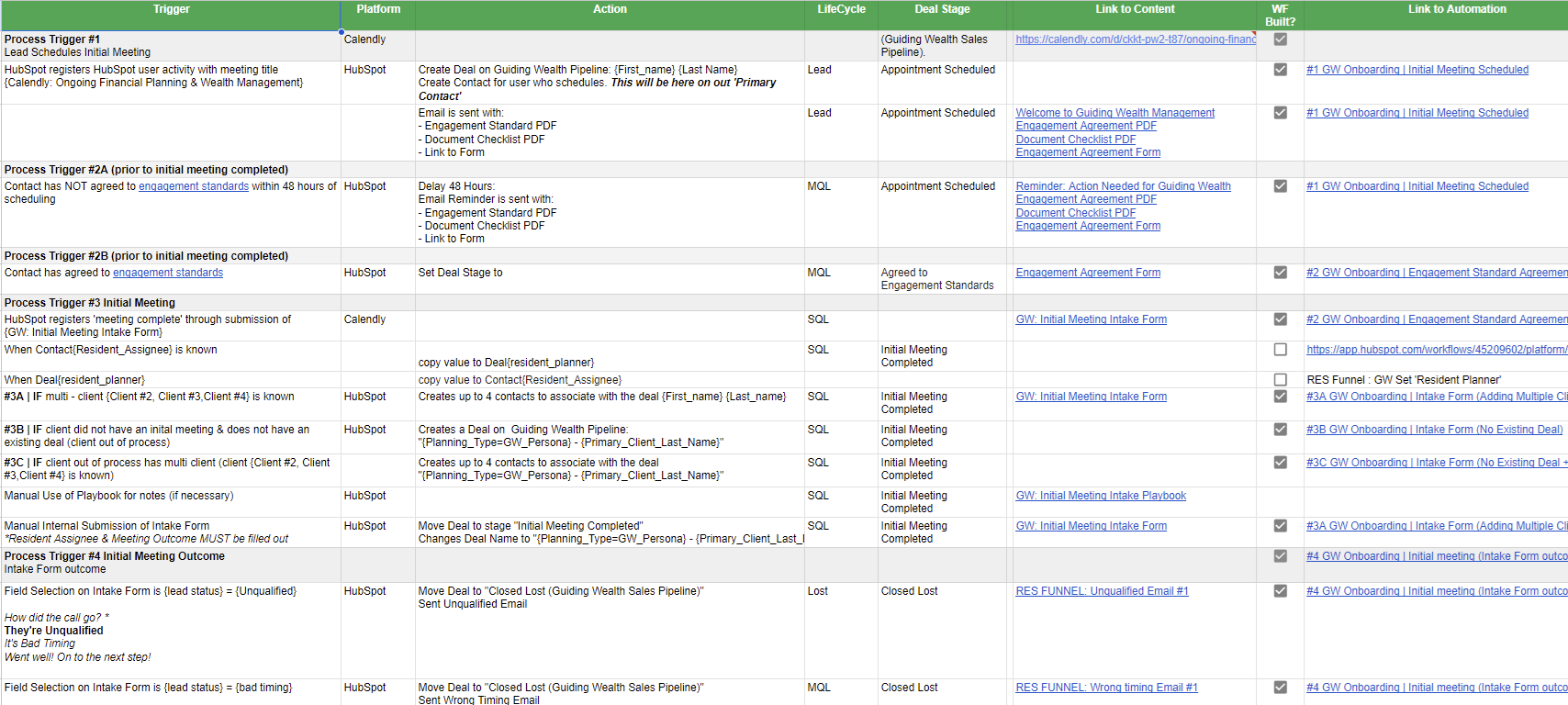

Automation Breakdown

Starting with a Calendly trigger, the information goes into and through HubSpot. Once a client is vetted and approved, the internal team uses a HubSpot intake form to trigger a Zapier automation that moves all financial documentation to Box and creates a Redtail CRM contact to streamline and secure their entire sales process. With client communication, document sharing, and compliance actions throughout, this process ensured each step, from client intake to contract finalization, adheres to confidentiality requirements while minimizing manual input.

.png?width=1225&height=2000&name=GW3%20(multi%20client).png)

Initial Consultation Scheduling

(Calendly → HubSpot) Client schedules an initial consultation using Calendly. HubSpot registers the meeting, creates a new deal, and generates a 'Primary Contact' in HubSpot.

Document Distribution

(HubSpot) Automatically sends the client an email containing important PDFs (Engagement Standard, Document Checklist) and a form link for further details.

Engagement Standards Follow-Up

(HubSpot) A 48-hour delay triggers a reminder email if the client hasn’t agreed to the engagement standards.

Initial Meeting & Intake

(Calendly → HubSpot) Post-meeting, HubSpot updates the deal stage based on intake form submission and creates additional contacts for multi-client scenarios, ensuring all clients are associated with the correct deal.

Quote Generation & Payment

(HubSpot) A manual quote is generated within HubSpot, with details like line items, payment plans, and signatures.

Contract Completion

(Zapier + Box) Upon payment, a client folder is created in Box, containing vital client information such as contact details and the signed quote.

ReClient Registration in RedTail

(Zapier + RT) Once the client is fully onboarded, all relevant contact details are pushed to RedTail to complete the process.

.png)

.png)

-1.png?width=720&height=720&name=Untitled%20design%20(49)-1.png)

Creating contacts with a single form

In working with Guiding Wealth’s automation, one key challenge was HubSpot's single-contact dependency on forms and its limited auto-association capabilities for multiple contacts within a deal. For a financial planning firm, each client needs to be individually identifiable, and HubSpot’s default structure didn’t support that. To solve this, I introduced an intake form at the third deal stage, “Initial Consultation,” filled out by the internal team, designating the first associated contact as the "primary contact."

The intake form used auto-fill rules to link it to the primary contact and the respective deal. I created sets of custom contact properties for additional clients (e.g., “Client #2 First Name,” “Client #2 Email”) that scaled up to four contacts. The automation then used a deal-triggered workflow: when the system recognized a deal associated with a secondary client, it created an individual contact using the primary contact’s details. Conditional branches handled up to four contacts, ensuring each was accurately associated with the main deal, titled with the client’s last name and financial planning type.

Compliance First: Transfer to Redtail CRM

To support compliance and data security for Guiding Wealth, we set up a seamless integration between HubSpot and Redtail—a secure, compliance-driven CRM specifically designed for financial planning.

-

Automated Document Management:

- HubSpot automatically sends signed financial agreements in PDF format to Box.

- Redtail, integrated with Box, then auto-associates these documents with the relevant client account, ensuring easy access and compliance.

-

Data Collection via Intake Form:

- The intake form in HubSpot collects essential personal details (e.g., address, phone, name, title).

- To protect sensitive information, like SSNs or ITINs, these were excluded from HubSpot’s scope.

-

Account Creation in Redtail via Zapier:

- Using Zapier, we set up automated account creation in Redtail based on intake form responses.

- Financial planners then gather sensitive client data directly and input it securely into Redtail, while general client information is already populated.

.png)

Digital Marketing Package

For this project, I created seven unique sets of CMS content, each tailored to a specific type of financial planning. This included seven distinct landing pages, each equipped with customized forms to initiate unique email drip sequences and linked payment portals. Each page’s form served as the entry point to a specific service funnel, allowing us to vet potential clients through an initial consultation. From there, qualified leads were automatically assigned to the most suitable financial planner for a personalized experience.

Final Thoughts

This project marked a technical evolution for Guiding Wealth operations. Through advanced automations, multi-platform integrations, and encrypted compliance measures, the system drove significant improvements in operational efficiency.

Looking for design & development services?

Check out my design portfolio for examples of website and landing page development. You'll also find my collection of digital collateral - emails, CTA's, popups, and Ebooks - all designed and developed by F&FTS.

.png)

.png?width=1200&length=1200&name=ac27a69ace204ff5beaadcf49bf84077%20(1).png)